5 Simple Techniques For Refinance Deals

Table of ContentsLittle Known Facts About Best Refinance Deals.The 45-Second Trick For Best Refinance DealsThe Buzz on Refinance DealsBest Refinance Offers - Truths9 Easy Facts About Best Refinance Offers ShownWhat Does Best Refinance Offers Mean?The Best Strategy To Use For Mortgage Refinance DealNot known Incorrect Statements About Best Home Loan Refinance Offers

e. the number of years it takes to pay off the loan) to fit your needs. By increasing your loan term, you can reduce your routine payments over a longer period of time. By decreasing your loan term, you may increase your payments however pay less interest overall.: It's important to do your research before you think about re-financing as there can be a variety of costs included.It could cost hundreds and even thousands of dollars to change if you're not careful.: If your equity is less than 20% of the residential or commercial property worth, your loan provider may require you to secure Lenders Home Mortgage Insurance Coverage (LMI) when you change. This safeguards the loan provider if you default on your home loan, but could end up putting you seriously expense.

Best Home Loan Refinance Offers Things To Know Before You Buy

Refinancing your home loan frequently could affect your which can make it hard to get lower interest rates for future applications. It's not uncommon at all for people to refinance their house loans within simply 3 months of purchasing their property!

Extremely seldom does it involve investing more time on discovering the right home mortgage, but the loan is just as important. Eventually, refinancing is not going to match everyone in every scenario. It is necessary to take a look at your private scenarios and weigh up all of the pros and cons prior to making a move to do so.

How Mortgage Refinance Deal can Save You Time, Stress, and Money.

Rather, a cut-down part of the market has actually been considered. Some providers' items might not be offered in all states. To be considered, the item and rate must be plainly published on the product company's web site.

To check out how Savings Media Group handles prospective conflicts of interest, along with how we get paid, please check out the web website links at the bottom of this page.

How Best Home Loan Refinance Offers can Save You Time, Stress, and Money.

Your house is not just a location to live, and it is likewise not just a financial investment. Your home can also be a handy source of all set money to cover emergency situations, repairs, or upgrades.

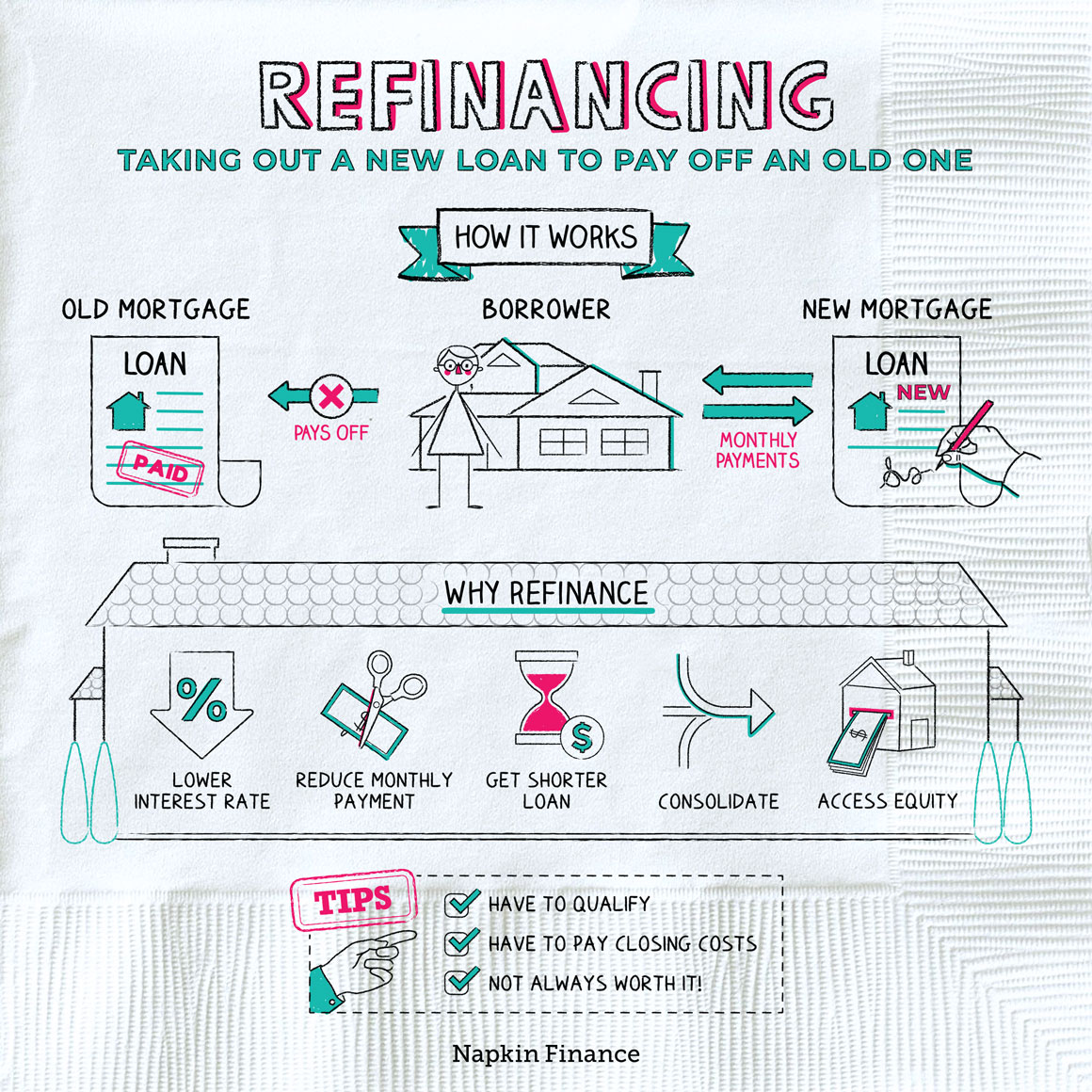

A cash-out refinancing pays off your old home mortgage in exchange for a new home loan, preferably at a lower interest rate. A house equity loan offers you cash in exchange for the equity you have actually built up in your residential or commercial property, as a different loan with different payment dates. best home loan refinance offers. Cash-out refinancing and house equity loans both provide property owners with a method to get cash based on the equity in their houses.

The Main Principles Of Best Refinance Deals

Both cash-out refinancing and home equity loans are Home Page kinds of home mortgage refinancing. There are a number of other kinds of home mortgage refinancing, and you need to consider whether refinancing is suitable for you prior to taking a look at the differences between cash-out refinancing and home equity loans. At the broadest level, there are two common methods for a home loan refinance, or refi.

In this kind of refinancing, no cash changes hands, besides expenses connected with closing and funds from the new loan paying off the old loan. refinance deals. The 2nd kind of refi is actually a collection of various alternatives, each of which launches some of the equity in your home: In this short article, we'll look at these two types of mortgage refinancing.

An Unbiased View of Refinance Deals

Even if you are delighted with your mortgage repayments and term, it can be worth checking out house equity loans. mortgage refinance deal. Perhaps you already have a low rate of interest, but you're searching for some additional money to pay for a brand-new roofing system, include a deck to your home, or pay for your child's college education.

Prior to you look at the different types of refinancing, you need to decide whether refinancing is best for you. mortgage refinance deal. There are a number of benefits to refinancing. It can supply you with: A lower interest rate (APR) of interest, A lower monthly payment, A much shorter reward term, The capability to squander your equity for other uses However, you should not see your house as a good useful reference source of short-term capital.

The 6-Second Trick For Best Refinance Deals

It can be an excellent idea to do a rate-and-term refi if you can recover your closing expenses with a lower regular monthly rates of interest within about 18 months. If you're not planning to stay in your house for an extended period of time, refinancing might not be the very best choice; a home equity loan might be a much better option since closing expenses are lower than they are with a refi.

You normally pay a greater rate of interest or more points on a cash-out re-finance mortgage, compared to a rate-and-term refinance, in which a home loan quantity remains the exact same. A loan provider will determine just how much cash you can get with a cash-out refinance, based upon bank standards, your see this page home's loan-to-value ratio, and your credit profile.

Get This Report about Best Refinance Deals

A cash-out re-finance can possibly go as high as an around 125% loan-to-value ratio. This suggests the refinance settles what they owe, and then the customer might be eligible for as much as 125% of their house's value. The quantity above and beyond the home mortgage reward is issued in cash simply like a personal loan.

, such as points. Cash-out loans are more complicated than a rate-and-term and usually have higher underwriting requirements.